IFRS16 COMPLIANCE

Achieve an effective lease agreement tracking and ensure IFRS 16 compliance by integrating iLeAS to your ERP System. IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases.

IFRS 16 requires all major leases included in the balance sheet

|

|

Right-of-use Asset Right to use the underlying leased asset |

|

|

Lease Liability Obligation to make lease payments |

Lease Definition

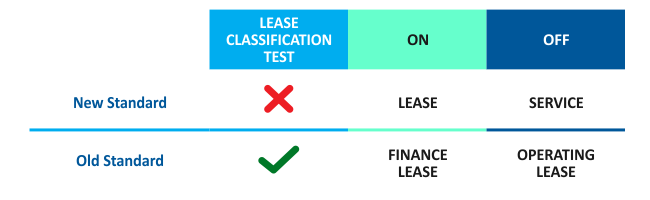

The new on/off-balance sheet test for lessees - a key judgement area

Lease Definition - Exempsions

Two major optional exemptions make the standard easier to apply

Advantages of iLeAS

|

Deploy as an extension to Oracle EBS Solution or as a stand-alone Cloud solution to connect to other ERP Applications |

|

Enables synchronization with General Ledger for accounting entries and Accounts Payable for lease rental invoices |

|

Leverage dashboards and the reporting features for all lease reporting requirements and streamline operations |

Functionalities

|

|

Record all leases (Property, Equipment, etc.) |

|

|

Define the rental schedule with clauses for revision, payment frequency |

|

|

Integrate with Accounts Payable for Invoice creation as per payment schedule |

|

|

Calculate the Right of Usage (RoU) Valuation based on the IRR or borrowing rate and also the Lease Liability in line with the IFRS 16 recommendations |

|

|

Integrate with GL to create the accounting entries for the RoU and Lease Liability values |

|

|

Generate the Amortization calculation and the accounting entries to GL |